Secrets of Forex Trading 📉 Key Technical Analysis Patterns

Strategy

September 2024

The markets may seem chaotic and unpredictable to the untrained eye, seasoned traders recognize patterns amidst the chaos, harnessing them to predict future price movements with uncanny accuracy. In this illuminating guide, we'll delve deep into the realm of technical analysis, uncovering key patterns that every aspiring trader should know.

Understanding the Foundation: What is Technical Analysis?

Before we dive into the intricacies of specific patterns, let's first establish a solid foundation by understanding what technical analysis entails. Unlike its counterpart, fundamental analysis, which focuses on evaluating the intrinsic value of an asset, technical analysis revolves around studying historical price data and market statistics. By identifying recurring patterns and trends in this data, traders aim to forecast future price movements and make informed trading decisions.

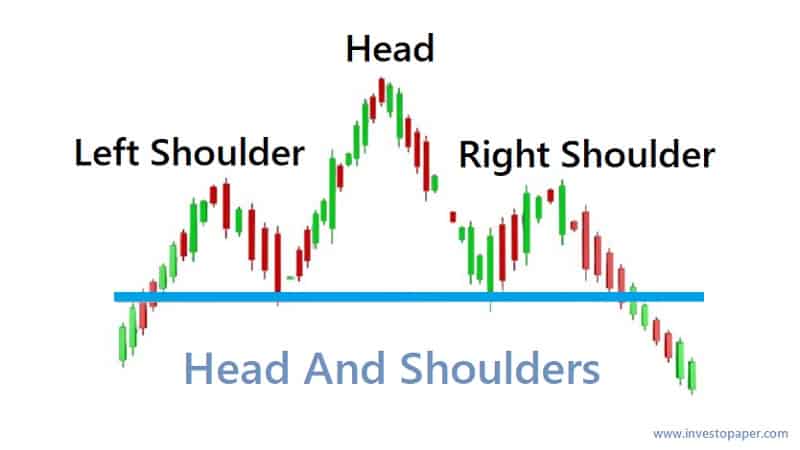

Head and Shoulders Pattern: The King of Reversals

Spotting the Beast: Keep a keen eye out for a peak (shoulder), followed by a higher peak (head), and then another peak (shoulder) at a similar level to the first. This pattern signifies a potential trend reversal from bullish to bearish.

Did You Know? According to a study by renowned technical analyst Thomas Bulkowski, head and shoulders patterns have a striking accuracy rate of approximately 83%.

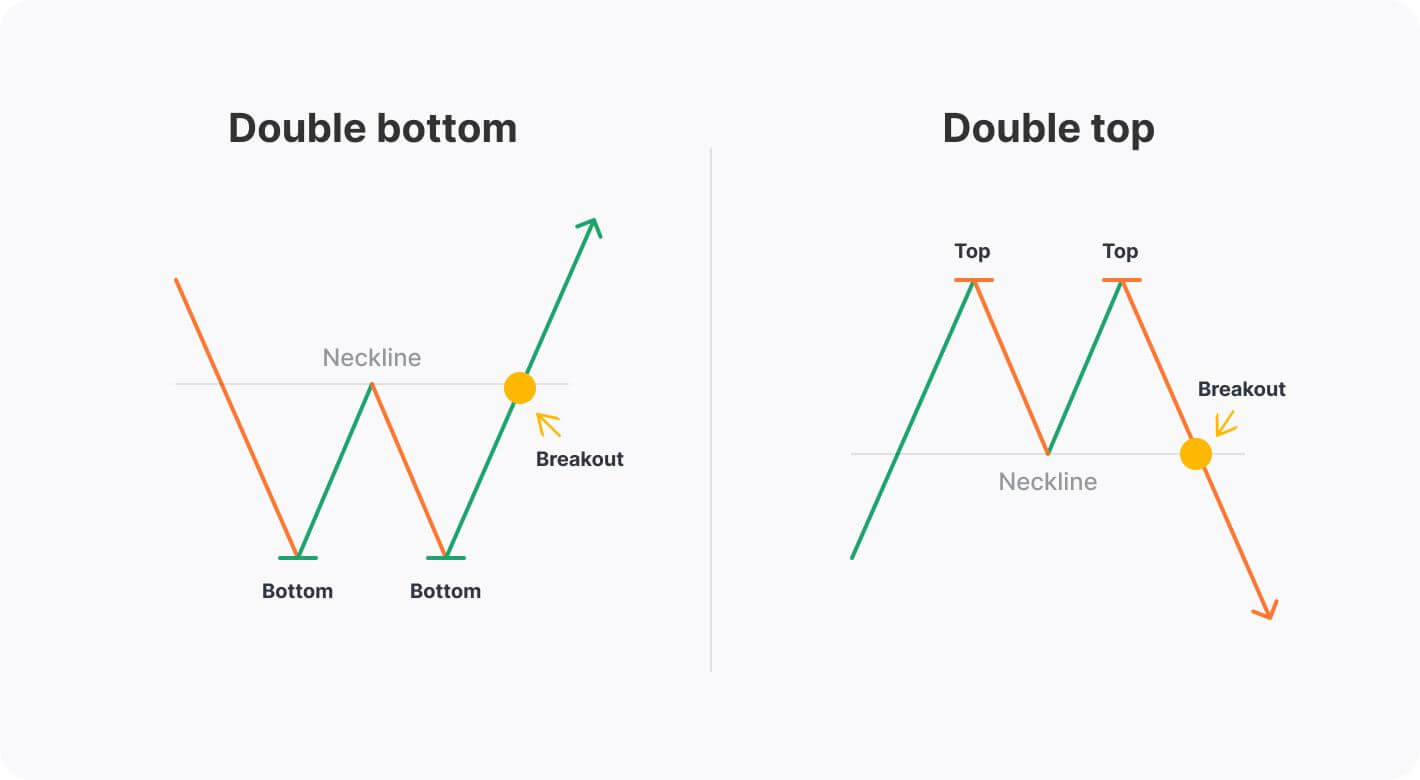

Double Top and Double Bottom: The Tale of Twin Peaks 👯♂️

Seeing Double: In the case of a double top, observe two distinct peaks at approximately the same price level, separated by a temporary trough. Conversely, a double bottom features two consecutive troughs with a minor peak in between. These patterns indicate a potential trend reversal.

Fun Fact: Research indicates that double bottom patterns outperform double top patterns, with a success rate of around 65% compared to 62%.

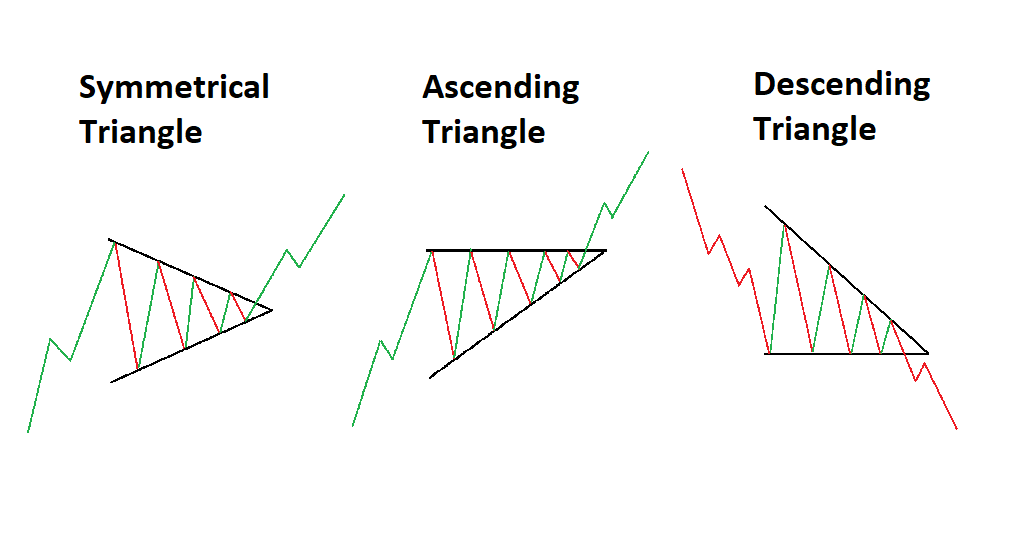

Ascending and Descending Triangles: Riding the Waves of Continuation 🌊

Triangle Tales: Ascending triangles are characterized by a horizontal resistance line and a rising support line, converging towards a breakout point. Conversely, descending triangles feature a horizontal support line and a descending resistance line. These patterns suggest a continuation of the existing trend.

Food for Thought: Ascending triangles tend to resolve upwards approximately 63% of the time, while descending triangles break downwards around 64% of the time.

Navigating the Forex Seas: Practical Tips for Traders

Stay Vigilant: Keep a watchful eye on multiple timeframes to confirm the validity of your analysis. 👀

Embrace Technology: Leverage advanced charting tools and indicators to enhance your analytical prowess. 💻

Mind the News: Be mindful of economic events and news releases, as they can significantly impact market sentiment and invalidate technical patterns. 📰

Mastering the Art of Technical Analysis

Armed with the knowledge of these key patterns, aspiring traders can navigate the treacherous waters of Forex with confidence and precision. Remember, while technical analysis provides invaluable insights, it's essential to combine it with sound risk management practices and a dash of intuition. So, equip yourself with the right tools, hone your skills, and embark on your journey towards trading mastery. The world of Forex awaits, ready to reward those who dare to decipher its secrets. 🚀

📮FAQ

Some Frequently Asked Questions.

See other articles

Artificial Intelligence (AI) has emerged as a transformative force in various industries, revolutionizing the way we live, work, and invest. Among the promising developments in the AI landscape is ChatGPT, an advanced language model designed by OpenAI. This article delves into the captivating rise of AI stocks, with a particular focus on ChatGPT, as it continues to garner attention from investors and technology enthusiasts alike.

Buying investment property can be an excellent way to generate wealth and monthly income through rent. However, real estate also carries risks like responsibility for maintenance and repairs. If you want real estate exposure without the direct ownership hassles, there are alternative investment options to consider. Here are 3 ways to invest in real estate without actually buying a property:

Coffee is a beloved beverage enjoyed by people all over the world. But some coffees are more expensive than others, thanks to their unique flavor profiles, limited availability, or special production methods.